Sector: Finance

Aplicación: Certification

Empresa: Banco Santander, CaixaBank and 14 European banks

International trade has been central to economic and social development, today accounting for about 57% of the world’s wealth (global GDP). Put another way, more than 50% of the world’s GDP is dependent on international transactions, which shows the significant weight of international trade in driving economic growth.

However, there is still a long way to go to facilitate access to international trade for SMEs (which account for 90% of the world’s businesses). To advance in this direction, barriers to accessing international trade need to be removed. These include a lack of trust between buyers and sellers, the risk of non-payment by the buyer or delivery by the seller, low levels of standardisation and digitalisation, and the lack of transparency and information between parties.

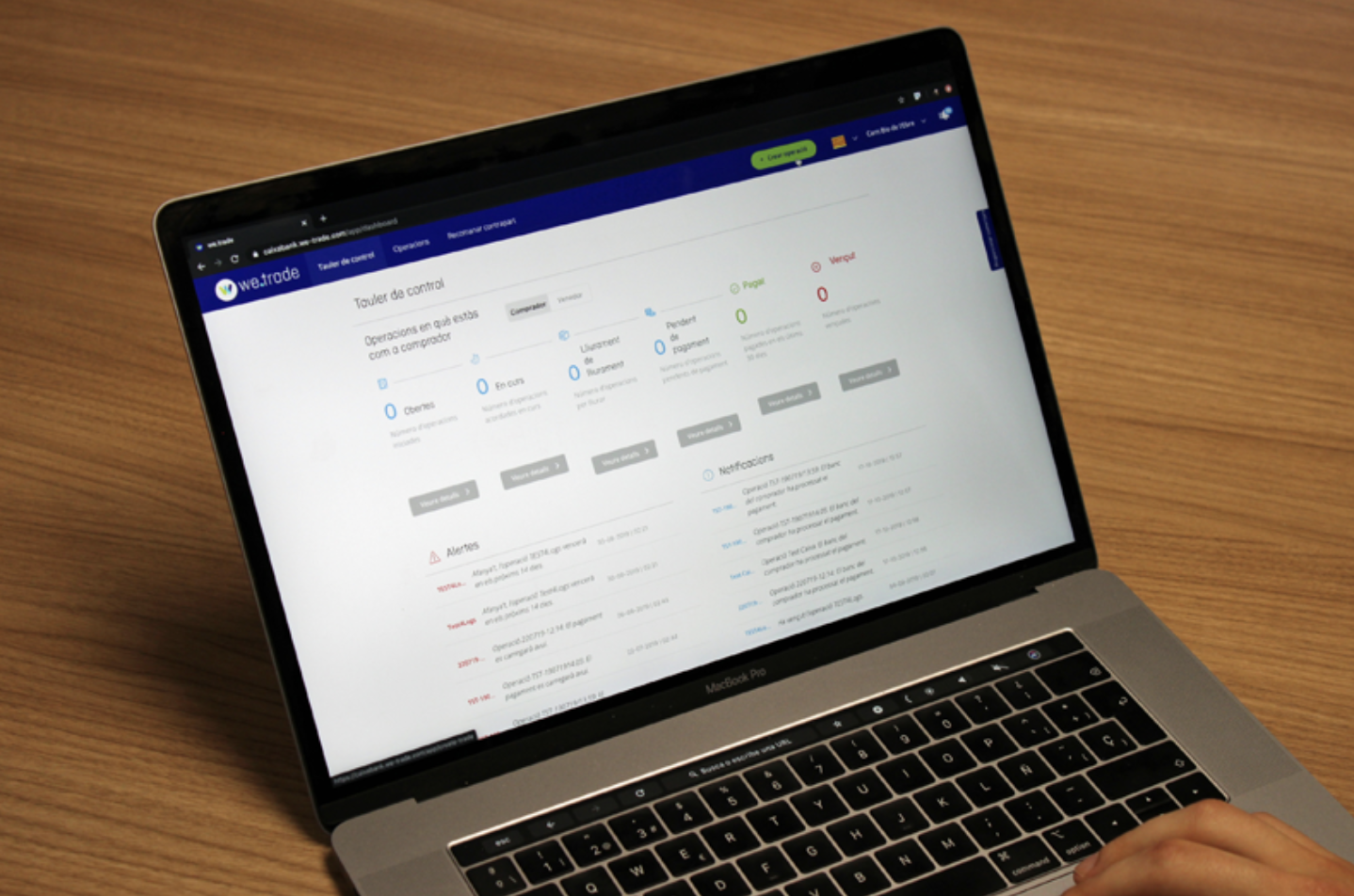

We.Trade is the first blockchain-based platform in Europe that provides a secure digital environment to facilitate international trade transactions (buying and selling). It simplifies operations and provides an environment where companies can operate with security and confidence, thus helping SMEs to overcome the main barriers to accessing international trade.

We.Trade is made up of a consortium of 16 European banks, including Banco Santander and CaixaBank, which facilitate the operations of companies in European markets (https://we-trade.com).

Why blockchain?

We.Trade connects buyers, sellers and their banks on a single platform powered by blockchain technology. The solution digitalises international transactions from end to end, creating transparency and allowing transactions to be monitored continuously on a single platform. The negotiation and commercial agreement between buyer and seller are logged on the same platform and systematised through a binding smart contract. Thanks to this smart contract, payments are executed automatically.

How it works

- Counterparty selection: the companies in We.Trade have passed the banks’ KYC/AML1 and risk processes.

- The negotiation and commercial agreement between buyer and seller are logged on the same platform, without the need to exchange emails or calls. After the terms and conditions of the transaction have been accepted by both parties, the agreement is systematised through a smart contract and becomes binding.

- Automated payment: thanks to the smart contract, once the payment conditions of the commercial agreement reached have been met, payment is made automatically, making the payment process easier for the buyer and mitigating the risk of non-payment for the seller.

- Integrated access to banking services and products: We.Trade allows access to payment guarantees (bank payment undertaking), invoice financing and guarantee financing on the same platform, facilitating access to credit for SMEs.